Assuming you have notified your credit card company ahead of time that you’ll be traveling or living outside of the United States, using your U.S.-issued credit cards in Italy should not be a problem. They are “every place you want to be,” as the advertising slogan goes. Restaurants, grocery stores, tourist shops — pretty much every business around accepts credit cards, and the country where those cards were issued is basically irrelevant.

There are situations, though, when the country of issue does matter. But these limitations, at least in my experience so far, are imposed by the company accepting the credit card, not by the card issuer — when the company states that it will only accept credit cards that were issued in Italy.

Two specific companies I’ve come across so far with this limitation are the cellular service provider Vodafone and Servizio Elettrico Nazionale, the Italian electric company. In both cases, when I tried to recharge my Vodafone SIM card or pay my electric bill online, my U.S.-issued credit card was rejected.

You can pay for these services elsewhere, of course — at tabacchi, post offices, and so forth — where your U.S. card will be easily accepted for either type of payment. But this involves going to the location, waiting in line, and probably paying a “convenience fee” surcharge. Paying online from home is obviously far easier and less expensive.

Fortunately, it can be done. And you don’t have to get an Italian-issued credit card, your U.S. card will work fine. You just have to be a little bit clever about it.

Both Vodafone and SEN — and probably most other companies like this — accept online payments via credit card and via PayPal. And PayPal just happens to be a credit-card processor. So….

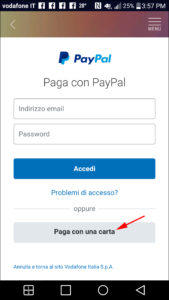

You go online (or in the mobile app) to recharge your SIM card or pay your electric bill. At the company’s payment page, you select to pay via PayPal — not to pay with a credit card. This will take you to PayPal’s website. Then when you get there, instead of signing into PayPal to make a PayPal payment, you select their option to pay with a credit card.

This will bring you to a screen where you fill in your credit card information and complete your payment as usual. Voilà! You have made your payment online using your U.S. credit card, and the company that doesn’t accept them is none the wiser.

What actually happens here is that PayPal inserts itself in between the company you are trying to pay and your U.S. credit card. PayPal — not the company you are paying — is the one who charges your credit card. And then PayPal forwards that money along to make the payment for your bill. So as far as the company you are paying is concerned, the payment is coming from PayPal. But for you, the payment is still being billed to your U.S.-issued credit card.

Think of it as an innocuous form of money laundering.

You do not even need a PayPal account to do this, because in this situation PayPal is acting merely as a card processor — a middleman — and not as a self-contained payment system. So PayPal will process your card payment regardless of whether or not you have a PayPal account.

There are a couple of caveats here that you need to watch out for, however.

First off, PayPal has a policy that, if you do have a PayPal account, it will first use all of the funds in that account to make your payment, and only then bill any remaining difference to your credit card. This is obviously not good if you are trying to keep those funds in PayPal, or make the highest credit card payment to get cash back, etc. If you wanted to pay with your PayPal funds, you’d be doing that in the first place.

So be sure to carefully read any payment screens, especially if you get one that tells you where the payment funds are coming from. If they are trying to take the funds from your PayPal account, you will need to make sure you are signed out of PayPal, and you might possibly want to use “incognito mode” on your browser. This can help prevent PayPal from knowing who you are and draining your account against your wishes. Also, the credit card payment process requires an email address, and you should provide a different address from any that you use for your PayPal account(s).

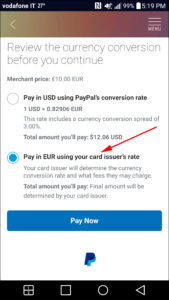

A second caveat — one which ironically can help you avoid the problem of the first one — is that if you are paying a bill denominated in euros from a PayPal account that contains only U.S. dollars, PayPal will want to convert that bill to dollars before it charges your credit card. Unfortunately, PayPal does not give you a very good exchange rate when it does this.

The good news is that PayPal gives you an option: You can accept their exchange rate, or you can choose to use your card issuer’s exchange rate. In the first case, PayPal converts your euro payment to dollars (at their not-very-good rate), then charges your credit card in dollars to make the payment. In the second case, PayPal simply charges your credit card in the original euros, and your card issuer then converts euros to dollars for your bill.

My experience (with a Chase Ink credit card) is that you get a far more favorable exchange rate by allowing the card issuer to do the conversion. On one large transaction last spring (about 1400 euros), the savings were close to $100, just from the exchange rate difference. I’d much rather that money be in my pocket rather than PayPal’s, if you know what I mean.

So when you get to the screen where PayPal gives you this option, I would suggest selecting your card issuer’s exchange rate.

A bonus for selecting the card issuer’s exchange rate is that PayPal is then unable to dip into any PayPal account you might have for part of the funding– it must charge the full amount to your credit card, because it has to pay in euros. This is true even if they know who you are — for example, through your email address. Unless, of course, you carry euros as well as dollars in your PayPal account. In that case, PayPal may still drain your euro balance first, unless you take the steps outlined above to prevent them from knowing you have an account.

One other issue to be aware of here is any foreign transaction fees that your card issuer might charge — these can negate any exchange-rate benefit you might get from using the card’s exchange rate rather than PayPal’s. But if you’re going to be using your credit card extensively in Italy (or anywhere else outside the U.S.), you already have a card with no foreign transaction fees, right?

So — There’s how to pay a bill online using your U.S.-issued credit card, even if the company you are paying accepts only Italian-issued cards. This is based on my experiences so far — your mileage may vary. If you do have experience in this area, feel free to share it in the comments below.

Great helpful article. Thanks, Ed. I hadn’t thought of PayPal. Of course, I have to have Internet in order to access it. 😄

True… But I guess you need Internet to make any kind of online payment… 🙂